Trials and Tribulations of Darragh Macanthony

Mr. Macanthony is waiving the banner of victory and some calculated dose of persecution mania since knowing that the “Audiencia Nacional” has chosen to defer the criminal complaint filed for swindle and misappropriation to the Courts in Marbella. Alas, he has conveniently omitted the fact that the Courts have not made any comment on the claim itself other that stating that this likely criminal activity is to be heard elsewhere.

Mr. Macanthony is waiving the banner of victory and some calculated dose of persecution mania since knowing that the “Audiencia Nacional” has chosen to defer the criminal complaint filed for swindle and misappropriation to the Courts in Marbella. Alas, he has conveniently omitted the fact that the Courts have not made any comment on the claim itself other that stating that this likely criminal activity is to be heard elsewhere.

The Audiencia Nacional has taken the route of stating that the “possible” swindle and misappropriation is not in a massive scale that could affect the normal performance of the Spanish economy, and thus determines that it should be the Marbella Courts who should deal with this matter.

Our choice of the Audinecia Nacional was based on the multiplicity of points of contact which involved several jurisdictions, including a 90-year-old Peruvian-domiciled yet Madrid-based Spanish former civil-war combatant who was the director of choice for Mr. Macanthony’s companies, claimants from different countries and defendants equally based abroad.

From a substantive-law point of view, the same rules apply whether it is the Audiencia Nacional or the Court of Instance. From a procedural point of view there will be variations.

As a result of this rather inconvenient criminal complaint, Mr. Macanthony has clearly taken a personal distaste for me and has reserved his best and most emotive words for the undersigned: ambulance-chaser, small-time lawyer, non-real lawyer and rather insultingly and defamatory, the concocting of a twisted story whereby I had approached his representative in Marbella, asking for money in exchange for dropping the case by spuriously persuading my clients that there was no such case to be had (when the reality is that two lawyers in our firm had been approached by him, on instructions of Macanthony, proposing that we became his new Spanish representative, with an offer of a blank check; This man failed to mention whether it was a Euro or Soles-denominated check, the Peruvian currency).

Claimants have requested from the Courts that Mr. Macanthony answers the following:

- Where is the money paid by 51 of his former clients for furniture packs?

- Why did he alternate company directors, choosing an insolvent 90-year old man, Fernando De Arespacochaga Alcalá del Olmo, living in Lima, Perú, to front a company acting as a director for his dying companies?

- Why did he re-domicile his companies to a non-descript office in Madrid that serves as a cemetery for creditor-dodging companies?

- Why did lucid Mr. Arespacochaga appoint in March 2005, November 2005, December 2006 and December 2009 four different company directors, all of which now deny knowing what were their roles?

- Why did he disappear from Spain and not file for insolvency? (reputation perhaps?)

- Why is he the subject of a forum with over one thousand members with an axe to grind? (this I think he has answered…).

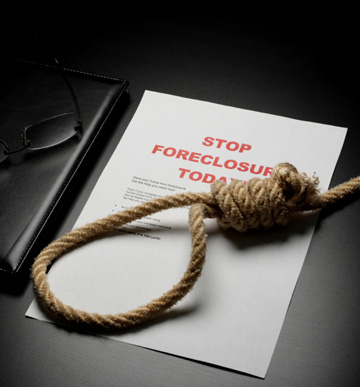

My client has had a narrow escape: having been notified in early March by the courts that his property was to be auctioned by Danske Bank, at 11:00h of the 8th of June 2011, we managed to obtain from the same court a ruling suspending the auction exactly…24 hours before (just like that one last call from the Alabama Governor…)

My client has had a narrow escape: having been notified in early March by the courts that his property was to be auctioned by Danske Bank, at 11:00h of the 8th of June 2011, we managed to obtain from the same court a ruling suspending the auction exactly…24 hours before (just like that one last call from the Alabama Governor…)