Spanish Mortgage Loan Anti-Eviction Laws Arrive on Time for Some

68 year-old Anne may have been “saved by the bell”, as she fully qualifies for Court protection under new anti-eviction legislation just passed by the Spanish Government, at least during 2 years.

68 year-old Anne may have been “saved by the bell”, as she fully qualifies for Court protection under new anti-eviction legislation just passed by the Spanish Government, at least during 2 years.

Her story probably epitomizes the greed of most banks, and their bankers, in pursuit of sky-high profits, commissions and promotions. Predatory, crazy, irresponsible, avaricious are some words that can be applied to what happened to Anne, a story where a bank actually forced a loan on someone who was, at the time, convalescing of a cancer operation.

Anne owned a small apartment outright in Marbella, had some savings inherited from her late mother and after having beaten a life threatening cancer stumbled across a lender, Jyske Bank Gibraltar, who convinced her that she should take up the opportunity to access cheap money and upgrade her living conditions by taking out 2 loans, using the spare cash savings to top up the bank’s money and then, hopefully, get some fresh new income by renting one of the two and…bla bla, as we all now know.

The odds were clearly against her: she could not prove she had an official income in Spain after 20 years living here (had never been registered with the Spanish Social Security system), was not able to work and relied on a €600 pension from the Belgian Government. No worries, Jyske Bank Gibraltar, after “carefully studying the case”, concluded she was a suitable borrower and eligible to take out 2 loans worth €550,000, repayable during then next 35 years. But quite how she intended to repay them remains a mystery even today, presumably even to Jyske’s Christian Bjørløw. What were they both thinking…? Was Jyske also convalescing…?

The law passed yesterday stipulates that even if her home has been repossessed, she qualifies for a 2-year moratorium as she has not yet been evicted. Time to type up a writ to the Courts!

It is only a few days ago when we

It is only a few days ago when we  Having met with dozens of victims of the Equity Release fraudulent scheme, we asked some of them if they would be happy to be interviewed; the result was very positive, with some willing to be interviewed every week, if need be!

Having met with dozens of victims of the Equity Release fraudulent scheme, we asked some of them if they would be happy to be interviewed; the result was very positive, with some willing to be interviewed every week, if need be!

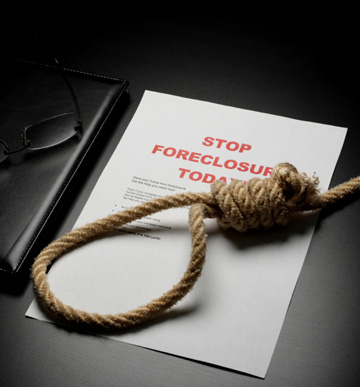

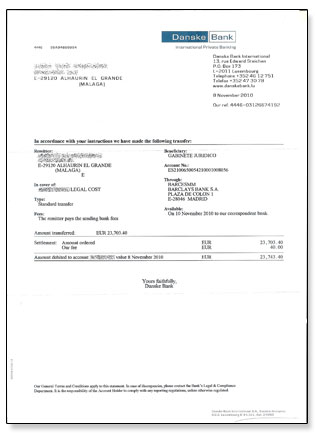

My client has had a narrow escape: having been notified in early March by the courts that his property was to be auctioned by Danske Bank, at 11:00h of the 8th of June 2011, we managed to obtain from the same court a ruling suspending the auction exactly…24 hours before (just like that one last call from the Alabama Governor…)

My client has had a narrow escape: having been notified in early March by the courts that his property was to be auctioned by Danske Bank, at 11:00h of the 8th of June 2011, we managed to obtain from the same court a ruling suspending the auction exactly…24 hours before (just like that one last call from the Alabama Governor…)

The clients thought they’d be soon grinning from ear to ear once their application was approved, but the lenders knew that this ability to grin could be quickly challenged by grimace…

The clients thought they’d be soon grinning from ear to ear once their application was approved, but the lenders knew that this ability to grin could be quickly challenged by grimace…

Surfing the web in search for information on the so-called equity-release fiascos, I came accross a very interesting article in respect of

Surfing the web in search for information on the so-called equity-release fiascos, I came accross a very interesting article in respect of