Top 7 Worst Banking Practices I Have Come Across

It is only a few days ago when we read a story of an ailing 80-year-old diagnosed with Alzheimer and dementia, who had been sold €18,000 worth of… worthless financial products from CAM bank. The gentleman in particular had an officially recognized 80% disability, impaired vision and a history of strokes, and yet, he was persuaded by his branch manager into buying CAM shares for €9,000 and a further €9,000 on deposit, until year…3000!

It is only a few days ago when we read a story of an ailing 80-year-old diagnosed with Alzheimer and dementia, who had been sold €18,000 worth of… worthless financial products from CAM bank. The gentleman in particular had an officially recognized 80% disability, impaired vision and a history of strokes, and yet, he was persuaded by his branch manager into buying CAM shares for €9,000 and a further €9,000 on deposit, until year…3000!

This example of disgraceful behaviour, far from being an isolated case, adds on to a long list of what we could call “bankers´ most despicable actions” (we would completely miss the point if we thought that these are not man-made) and illustrates the utter disrespect and greed of certain individuals working for some banks.

So listed below are Top 7 Banks’ questionable at best, despicable at worst practices I have come across both in the exercise of the legal profession, and exemplifies the declining ethical standards within the industry.

- Equity Release: a scam that was operated by a number of Scandinavian and British banks where pensioners were asked to gamble away their lifetime savings on two main pretexts: that by registering a mortgage on their property, they could eliminate Inheritance Taxes for their children, legally, and that by investing the loan obtained from the mortgage they would obtain an additional income to their limited pension. A few criminal ongoing court actions, and an avalanche of soon to come civil suits will determine how ethical it was for Rothschild Bank offer a 90-year old a 90% loan on her property…

- Clip or Swap clauses on mortgages: financial products wrongly sold to mortgage-loan customers as insurance against increasing interest rates. The bona-fide insurance policy was in reality a complex derivative instrument. Most Spanish banks indulged in this awful practice and court cases are being resolved in favour of customers. Bankinter, Popular Bank and a few other culprits have lost 523 Court cases versus 90 ruled in their favour…

- Bad-advice provided by Deutsche Bank to its customers when advising them that Lehman Brothers and some Icelandic banks, which ultimately went bust, were, nevertheless, the investment of choice. Court number 57 in Madrid is currently dealing with the matter.

- Awful advice by Santander Bank when offering customers to invest with “world’s biggest conman” Bernie Madoff, despite knowing since 2006 the dangers of investing with him, according to the press.

- Deceitful advice given to long-standing clients by La Caixa, CAM, BBVA and many other banks to sign up “preferential shares”, when they thought they were depositing their savings on a fixed-deposit. Whereas one would think that younger, dynamic and financial-savvy investors would take on these products, this meeting held by very upset customers seems to suggest otherwise.

- Abusive use of the extra-judicial foreclosures by some banks. This repossession mechanism is generally (and inadvertently) agreed to by the borrower when signing the mortgage loan deed, is conducted by Notary Publics and can lead the bank keeping a property for €1. An association is fighting to expose this practice.

- And lastly, a shocking photographic report of Jyske Bank’s not-so-exquisite treatment of an evicted property owner, his belongings and the property itself, following a bizarre dispute lasting 18 years. The Gibraltar-based bank managed to regain possession of an offshore-company-owned property although not ownership, that was retained by the ultimate owner (our client), as confirmed by a number of quirky court rulings that nevertheless allowed Jyske to put their hands on this property with one sole purpose: destroy as much as they could!

Again and again, I receive requests for help from property owners struggling to pay the loan with whom I can only sympathize with, and, to the extent of my capabilities, offer my help. The problem is there is not much more one can do apart from

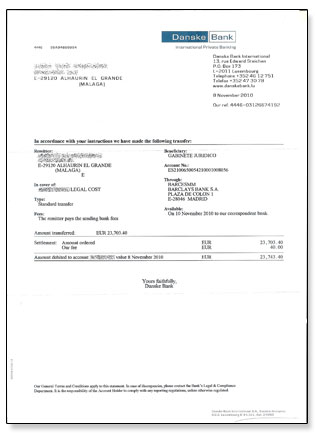

Again and again, I receive requests for help from property owners struggling to pay the loan with whom I can only sympathize with, and, to the extent of my capabilities, offer my help. The problem is there is not much more one can do apart from  I have an American client, Ray, who happens to be a CAM Bank client. Several months ago, Ray got caught up by this bank’s disastrous decision-making processes and stuck in what seems an unresolvable legal quagmire.

I have an American client, Ray, who happens to be a CAM Bank client. Several months ago, Ray got caught up by this bank’s disastrous decision-making processes and stuck in what seems an unresolvable legal quagmire.

As tempting as it may look, “handing over the keys” to the bank (

As tempting as it may look, “handing over the keys” to the bank (

After absorbing tens of thousands of properties through negotiation with defaulting borrowers, or via foreclosure proceedings, banks are now property-sicker than ever to take on anymore bricks and mortar that are less valuable than the loans registered against them.

After absorbing tens of thousands of properties through negotiation with defaulting borrowers, or via foreclosure proceedings, banks are now property-sicker than ever to take on anymore bricks and mortar that are less valuable than the loans registered against them.