Ever Heard of ‘The Danske Bank Kick in the Bollocks’?

December 14th, 2010

This is the question I was asked the other day by one of my clients who was about to show me the letter he had just received from his lender, the Danske Bank.

This is the question I was asked the other day by one of my clients who was about to show me the letter he had just received from his lender, the Danske Bank.

I am appealing to your empathy, and, to that extent, I want you to sit back and think, think how would you feel if after a life of hard work, when you were about to reap the deserved enjoyments of retirement and you had invested all your savings to purchase a hilltop beautiful villa on the Costa del Sol, the following happened (chronologically):

- You landed in Spain having sold your property in the country where you lived the last 60 years, cashed your pension and emptied your local bank accounts.

- You bought your retirement home with your life time savings, mortgage free.

- One sunny Saturday, one bloke, who happened to be a friend of a friend, turned up for lunch with a grin the size of a half-moon.

- After a few glasses of wine and after listening patiently to a rather boring recount of what you think is a vivid lifetime of experiences (might be for you, not for your new friend), this bloke, who you now think is a new friend, reacting with apparent anguish suddenly interrupts you to enquire whether your children are sufficiently protected against Spanish Inheritance Tax, which he conveniently sells as a happiness killer.

- Since by now, owing to the sun and the wine, you trust him, you open your ears and eyes as he explains that you are in serious danger of ruining your future, and that of your children.

- Avid to learn more, you enquire, and because he is in a hurry, he suddenly and quickly offers you a miraculous financial instrument to ensure that not only your unencumbered home is protected but also, you will have a monthly payment for life.

- By now you are well sober, listening to the wonder product that will protect your family plus give you some pocket money. Your friend tells you that he works for Danske Bank and that he can help.

[…]

A few years down the line

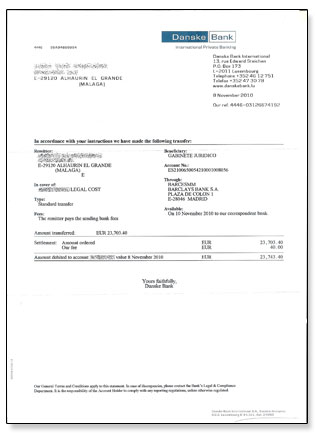

- Your friend has disappeared, your property has an embargo on it, Danske Bank is asking you to return €850,000 which you never saw and then you receive, by post, the following letter (click to open in PDF):

- Difficult as it is, you manage to read the letter, and you understand what it implies: your own bank, Danske Bank, without you ever writing to them, and who was entrusted with looking after, investing and providing a return on €1,030,000 (and which they managed to reduce by €850,000 thanks to cautious investing), which they extracted from your home on false pretences has the gall, in spite of it all, to let you know that you happen to have instructed them to debit your (blocked) account with €23,703, in cover of “LEGAL COSTS” in favour of their own lawyers’ account in Spain so that these lawyers can…errr, sue YOU and repossess YOUR home, after having efficiently lost your life time savings in some volatile very-high-risk Luxembourg bond that was sold to you as cautious.

You have now discovered what the “Danske Bank Kick in the Bollocks” is all about!

Absolutely scandalous!!!!!

How can Danske bank get away with this in light of everything that has happened over the last 3 years, surely Danske or any other bank should not be able to take advantage of people in this way.

Danske should address this situation immediately, I have heard about similar situations before but never as bad as this. This should be made as public as possible in order for other people to be protected from such a horrendous form of misconduct.

It appears that the IFA has “emptied” his website of compromising information and data.

This was his website in 2008: http://web.archive.org/web/20080623210422/http://www.ofsspain.com/

And his website in 2005: http://web.archive.org/web/20050207111417/http://ofsspain.com/index.html

And his website in 2002: http://web.archive.org/web/20020928051921/http://www.ofsspain.com/

This is surely a case of mismanagement of funds belonging to a client of the bank and as such shoud be described as both incompetence, negligence and theft from a clients account. The bank must be charged both civilly and criminally with stealing money from the client and should be made to pay it back. Not only did the account manager appear to badly invest the clients money but also charged the client a percentage every year for ^Managing^ his money. How shattering for the owner of the property to discover that the bank has lost all his money and now his house is at risk and has to be sold to pay the banks losses…….they should all resign and go back to Denmark and hide their faces. But we know they will not becsuse they are bankers and they take no risks with their money and pay themselves huge salaries and bonuses while we starve. Let their armpits be infested by the fleas of a thousand camels and may they never sleep a peaceful night without nightmares.