CAM Bank: The Worst Bank Ever?

I have an American client, Ray, who happens to be a CAM Bank client. Several months ago, Ray got caught up by this bank’s disastrous decision-making processes and stuck in what seems an unresolvable legal quagmire.

I have an American client, Ray, who happens to be a CAM Bank client. Several months ago, Ray got caught up by this bank’s disastrous decision-making processes and stuck in what seems an unresolvable legal quagmire.

Ray bought from a developer off-plan, back in 2005. In 2008 the properties were finished and licensed but, because the developer was running into problems, there were court cases being filed, and potentially embargoes being registered against the units, including his. So to protect him, on our advice he chose to complete on the property assuming the existing mortgage, without qualifying with the CAM as the application had not been submitted.

On a property valued at €900,000, he had paid more than half of it, during the course of the construction.

The situation was that he owned the property but the mortgage was in the developer’s name, although he kept his payments up to date. Twelve months ago, his loan fell behind by €300 during 3 days, and the CAM, because it coincided in time that they had just foreclosed on the loans on the other unsold units, seized the opportunity and did the same with his. Two days after this he had €20k in his account to cover several installments, but CAM refused point blank to reinstate. No other bank will lend him now, even though is not in a bad creditors list, because of this unusual situation.

This is an example that shows that some banks choose to be where they are: they are just bad banks with bad people running them, no more, and the CAM, the fourth largest savings bank in Spain, epitomises this.

Ray is not alone, as there seems to be a large number of clients who have had to deal with branch managers lacking the minimum common sense you expect from someone in their position. If you are one of those affected, we would love to here you story.

Today on Talk Radio Europe

For those of you interested, I will be today around 4.00 PM on the Life At Five with Allan Tee Show on Talk Radio Europe, to discuss this matter.

You can tune in directly through their website (internet stream), or through the FM frequency assigned in your area.

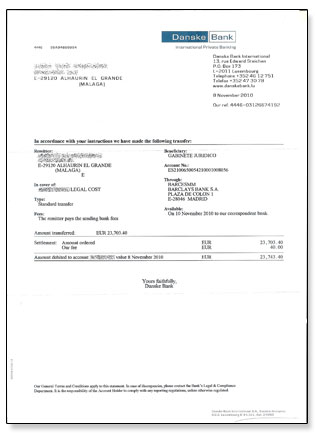

My client has had a narrow escape: having been notified in early March by the courts that his property was to be auctioned by Danske Bank, at 11:00h of the 8th of June 2011, we managed to obtain from the same court a ruling suspending the auction exactly…24 hours before (just like that one last call from the Alabama Governor…)

My client has had a narrow escape: having been notified in early March by the courts that his property was to be auctioned by Danske Bank, at 11:00h of the 8th of June 2011, we managed to obtain from the same court a ruling suspending the auction exactly…24 hours before (just like that one last call from the Alabama Governor…)

As tempting as it may look, “handing over the keys” to the bank (

As tempting as it may look, “handing over the keys” to the bank (

Banks must have done something really dodgy in respect of these Russian-roulette

Banks must have done something really dodgy in respect of these Russian-roulette

Following

Following  After absorbing tens of thousands of properties through negotiation with defaulting borrowers, or via foreclosure proceedings, banks are now property-sicker than ever to take on anymore bricks and mortar that are less valuable than the loans registered against them.

After absorbing tens of thousands of properties through negotiation with defaulting borrowers, or via foreclosure proceedings, banks are now property-sicker than ever to take on anymore bricks and mortar that are less valuable than the loans registered against them.