Buying Property in Spain? It Has Never Been Safer

I make no disguise that, professionally, I am closely connected to property, therefore this post, to many, will have limited significance due to obvious bias. If I was however to collate my experiences over the years, good and bad, when dealing in real estate in Spain, and I compare them with how transactions are conducted these days, I would necessarily conclude that it is now safer than ever to invest in property in Spain.

I make no disguise that, professionally, I am closely connected to property, therefore this post, to many, will have limited significance due to obvious bias. If I was however to collate my experiences over the years, good and bad, when dealing in real estate in Spain, and I compare them with how transactions are conducted these days, I would necessarily conclude that it is now safer than ever to invest in property in Spain.

The crisis has operated like an unstoppable tsunami that has swept right across the property market, sucking in its wake dodgy agents, opportunistic developers, corrupt town hall officials, crooked mortgage brokers (like the one that conned Banesto out of a few millions) and a handful of funny lawyers. And with them, a myriad of very questionable anti-property purchaser practices that had dangerously became close to standard, in spite of almost everyone living, directly or indirectly, on these bona fide consumers or investors. It may be convenient to enumerate these unethical antics, by trades, to keep things in perspective.

We must remember that:

- Never again should anyone pay any monies to a developer unless a bank guarantee or an insurance policy is available…, obvious isn’t it? More the point is that, realistically, insurance companies will never touch advance off-plan property payments and banks are likely to request unthinkable amounts of collateral. The immediate consequence of this is that only the very cash-strong will be able to develop and this is just good news.

- Never again should anyone pay monies to a developer who:

- Does not own the land (Citrus Europe Ltd.)

- Does not have a building license (Aifos)

- Cannot give bank guarantees (not enough space in this post to name them),

- Uses the deposits for a Murcia development to run a complex in Venezuela (Proyectos Antele S.L.)

- Uses a bent-as-hell agent as a deposit-collector who then ends up keeping them (Grupo Mirador and Palmera Properties/Gotardo)

- Runs away with the portion of the purchase price, earmarked for cancelling the loan on your property, to Germany (Abacon Delta S.L.)

- Sells a half built complex to a third party and does not refund (Citrus Playa Macenas S.L. and Ready2Invest )

- Takes 60 deposits for an Almeria development to a UK company and then dissolves it (again, Citrus Europe Ltd.)

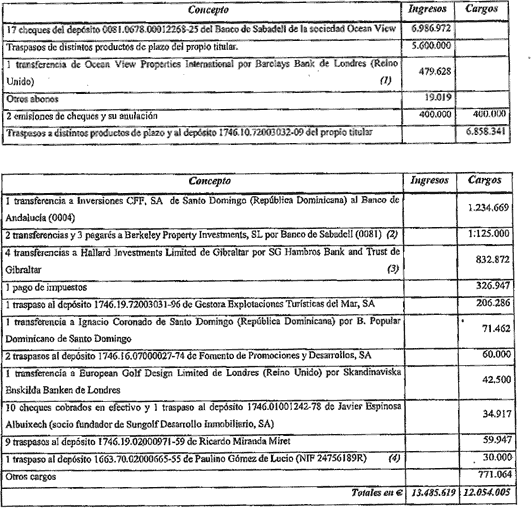

- Or all of those together plus sets up a Ponzi scheme, is known to have never built one property in his entire life in spite of claiming, at a fastouos ceremony, to have erected no less than 6,000 in the Costal del Sol, even persuading gullible Prince Albert to believe such bullshit! (Sun Golf Desarrollo Inmobiliario S.A. or Mr. Ricardo Miranda Miret).

- Never again will developers bully buyers as they were used to doing, as for example La Reserva de Marbella S.A. were experts at. I always wondered why was it that when you bought an apartment for €200,000 you were almost expecting to be treated like s**t, but if you went for a meal you were the king if you tipped handsomely…

- Never again will developers make you sign a private purchase contract for 70% of its real price, the balance of 30% to be paid to a Switzerland account, in advance, undocumented and, of course, never to be reflected on the private purchase sale deeds…(any ideas?? :))

- Very unlikely (never say never) will a Socialist/Communist Government, regional or otherwise, allow licenses to be granted on thousands of properties only to later, due to political opportunism and a spate of much publicized corrupt Town Hall officials arrests (which I agree with but without the cameras), instigate the revocation of almost all of these licenses, promote demolitions, warn of impending heavy fines on everyone, including the bona fide owners and, in sum, scare the hell out of thousands of those owners plus an undetermined number of potential investors in Spain.

With all we know now in respect of the degrees of criminality so many property developers ran into, an off-plan property industry that is almost non-existent (good old Taylor-Wimpey seems the only one around) and the property-associated corruption almost disappearing, the very few developers that are still around will no doubt jump through hoops to ensure that only la creme de la creme will be sold, at the right price of course!