Corvera Golf: Worrying Trends and Disparities in Rulings

Is Spanish off-plan property development dead? I would think so, considering the diverse value judges give to misleading advertising by property developers and, consequently, an increasing lack of trust in an already damaged sector.

Is Spanish off-plan property development dead? I would think so, considering the diverse value judges give to misleading advertising by property developers and, consequently, an increasing lack of trust in an already damaged sector.

The story goes like this:

Recently, a property developer in the north of Spain was sentenced to 21 months imprisonment for falsely advertising, on a billboard, that the urbanization he was developing would offer gardens, swimming pool and a children’s playground. Additionally, he had also indicated that the development would include adequate sewage infrastructure, water treatment plant, lighting and sidewalks…when, according to the sentencing court, he had no intention of providing such facilities.

Yes, a tough ruling by 3 tough magistrates who imposed a 21st century version of the Talion Law, exacting retribution to the defaulter in the most strict way possible, under Spanish law.

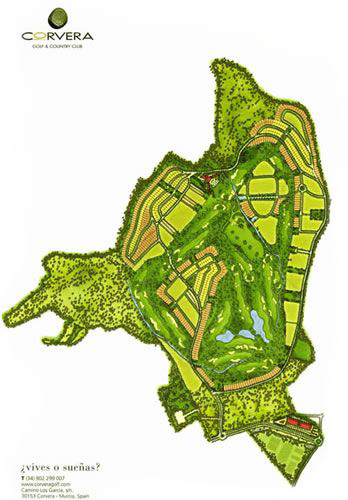

In an almost identical case by Court of First Instance in Murcia number 13, the Judge dealing with a dispute over unfinished facilities in Corvera Golf and Country Club accepted the following:

- That the construction of the promised 5-start hotel, to be run by Devere, was never started.

- That there are no, as recognized by the defendant, commercial centers, restaurants luxury hotel, health center nor a spa.

- That the promotional literature is fully binding, citing several Supreme Court rulings.

But, in stark contrast with the ruling that saw the Galician developer almost having to do time for fraud (received a suspended sentence), the Corvera Golf & Country Club developers, who had not built (and had no intention of doing so, as it happens), among others, a 5-star hotel, even though it had been offered, enjoyed a favourable ruling as the claimants’ civil claim for contractual default was dismissed.

And so, the question that remains to be answered: what is it that made this judge rule in such a manner?

Succinctly speaking, that the buyers did not prove that they had relied on the promised facilities to sign the contract! The judge adds that

“…the answer to the claim has to necessarily be negative for, on the one side, the contracts did not stipulate a deadline for building the promised amenities and, on the other, the buyer does not prove, in any way, that the concrete construction of the 5-start hotel and commercial center had, when exchanging contracts, such an intense relevance that it would justify pulling out the transaction should the amenities not be built…in fact, the golf course was indeed completed and the construction of such element was, as evidenced, the only element that was contractually agreed to.”

And to further justify his anomalous decision, he supported the developer’s argument that the 4th phase had not been completed, by which time presumably the hotel and other amenities would have been finished. What he did not feel relevant was the fact that Corvera developers had previously undertaken to the following, in respect to Phase IV:

“By reference to the main plot number 3832 Corvera Golf & Country Club reserves its rights for a period no less than 100 YEARS, to build the FOURTH PHASE of the community, which entails, in the event of this happening within the stipulated time, the proportional redistribution of the service charges being paid by other phases within the community.

Your honour, 100 years seems an awful lot of time to wait for the 5-star hotel, would you not agree?

An appeal has already been lodged.

Try to guess what is it that the following have in common: an electrical company from Alicante, a cement subcontractor from Valencia, a real estate company from the Balearics, the Spanish Inland Revenue, the Spanish Social Security, 6 banks and 65 employees (2 of which guard an empty plot), on the one side, and 150 consumers that were hoping to acquire Spanish off-plan property on the other.

Try to guess what is it that the following have in common: an electrical company from Alicante, a cement subcontractor from Valencia, a real estate company from the Balearics, the Spanish Inland Revenue, the Spanish Social Security, 6 banks and 65 employees (2 of which guard an empty plot), on the one side, and 150 consumers that were hoping to acquire Spanish off-plan property on the other. Since getting involved in legal action pertaining to unfinished-or-never-started-developments (e.g. by Ochando S.A., Promociones Eurohouse S.L. and Grupo San José Construcciones e Inversiones S.A.), one thing that I have found rather incomprehensible, from the perspective of a law firm actively pursuing the return of off-plan deposits, which should have been placed “in escrow” or backed by a bank guarantee, is the inconsistent and conflicting information on points of law that is being circulated by all manner of participants (lawyers, developers, group actions, banks, internet forums etc.).

Since getting involved in legal action pertaining to unfinished-or-never-started-developments (e.g. by Ochando S.A., Promociones Eurohouse S.L. and Grupo San José Construcciones e Inversiones S.A.), one thing that I have found rather incomprehensible, from the perspective of a law firm actively pursuing the return of off-plan deposits, which should have been placed “in escrow” or backed by a bank guarantee, is the inconsistent and conflicting information on points of law that is being circulated by all manner of participants (lawyers, developers, group actions, banks, internet forums etc.).

In Spanish, ‘La Verdad’ means ‘The Truth’. But it is also the name of a local newspaper in the Murcia region that

In Spanish, ‘La Verdad’ means ‘The Truth’. But it is also the name of a local newspaper in the Murcia region that