|

|

Bank Guarantees in Spain: All That You Ever Wanted to Know but Were Afraid to Ask

Raymundo Larraín Nesbitt - Lawbird Legal Services

12th of November 2008

Bank Guarantees are a legal tool devised to secure the deposits of prospective off-plan purchasers should their properties not be delivered on time or their developers file for bankruptcy. Post credit-crunch, bank guarantees are acting as safety nets for many purchasers in dire cases. Regrettably we have witnessed over the last months how some financial institutions are in fact refusing to honour bank guarantees. It is in such cases in which the need of a specialized litigation lawyer comes into play to help enforce them before a Law Court.

Bank guarantees may be a daunting minefield for many albeit with the assistance of an independent lawyer acting on your side you will be able to waive the pitfalls both safely and successfully.

Off-plan Property

Buying off-plan has many advantages but also its associated risks. Not long ago it was normal to obtain a significant discount (premium) on buying off-plan as you assumed a risk (mainly the uncertainty of the property ever being delivered and the time elapsed until completion) until the unit was ready to be delivered legally (with a Licence of First Occupation). Many took advantage in the boom selling on these properties for a sizeable profit prior to completion (also known as “flipping”) as it was basically a leveraged investment which only required a fraction of the funds paid up front. That same off-plan dwelling was significantly more expensive (i.e. 30%) if you purchased it key-ready as now there was no risk because it was finished. This, however, changed over time leading us onto today’s depressed market. Off plan hazards nowadays frequently outweigh the rewards, making the resale and let market look very appealing; that is until the dust settles and we start the boom cycle anew.

What is a Spanish Bank Guarantee?

A Spanish Bank Guarantee may be either an Insurance Policy or Guarantee issued respectively by an Insurance Company or Bank. In this article, for the sake of simplicity, we will group both types under the generic term bank guarantee. A bank guarantee purpose is to secure the full amount of deposits paid by off-plan purchasers. It secures the initial reservation deposit, which strikes the property off the market, the interim or stage payments as well as the applicable VAT (currently set at 7%) paid on said amounts. On top of this you are also entitled to the legal interests on the amounts secured.

A bank guarantee has a cost to be issued. Law states this expense must be borne by the off-plan developer. A bank guarantee is of critical importance acting as a safety net securing our full deposits should something go wrong.

How long does the Protection of a Bank Guarantee Last?

In strict accordance with Law 57/68 bank guarantees have no expiration date. They should only expire upon the granting of the Licence of First Occupation by the Town Hall (art 4) where the property is located. In practice this seldom happens and almost all bank guarantees are issued with an expiration date spanning typically 2 years. It is critical that your appointed conveyance lawyer renews them on time so your deposits are secured at all times.

What details should a Bank Guarantee include?

A bank guarantee should be individualised for each particular purchaser. It should include the following:

- Name & surname of purchaser/s.

- Their nationality & passport number/s.

- Their homeland address.

- The exact amount in Euros which is being guaranteed.

- Developer’s name.

- The name and address of the development where they are purchasing.

- The details of the residential unit they are purchasing i.e. Block 1, third floor, flat F.

- Name & seal of the Bank or Insurance Company guaranteeing said stage payments.

The number of the Registro Especial de Avales (if it’s a bank guarantee) as well as the bank account details where the secured amounts will be lodged.

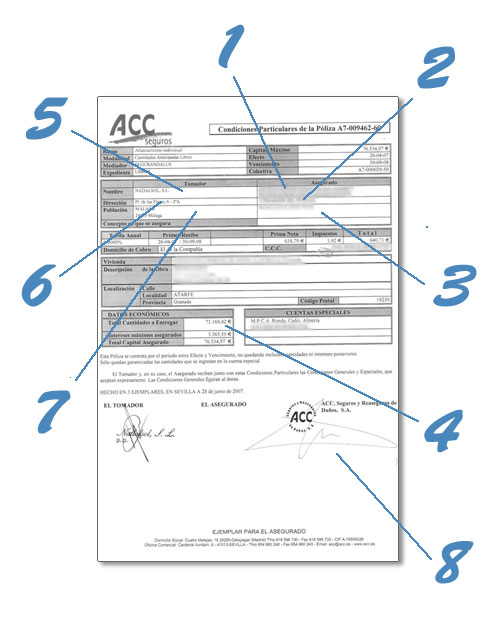

Figure 1: Anatomy of a Spanish bank guarantee

What the Law Says

Law 57/1968 rules the protection of stage payments in off-plan properties. This very short law of only seven articles was enacted to secure the stage payments of purchasers should for example a developer file for creditor protection or the build be cancelled for planning reasons and thus not delivered in the stipulated deadline. bank guarantees are only applicable to off-plan properties, not to resales.

Brief Overview of Law 57/1968

- Article 1 rules that developers will have to provide free of charge to the purchaser/s a bank guarantee or Insurance Policy (henceforth bank guarantee for either) to guarantee the refund of their stage payments plus 6% interest in the event of the developer becoming insolvent. The Building Act (Law 38/99) actually amends this percentage in its first additional disposition and it will be the legal interest set in the Budget Law published annually by Spain’s Law Gazette (Boletín Oficial del Estado). These legal interests are simple annual interests, not compounded. For 2008 the legal interest has been set at 5,50%. However if a developer expressly accepts the 6% interest set in Law 57/68 then said interest will overrule the legal interest (which currently is lower).

- Article 2 makes it imperative to include a clause in the Private Purchase Contract (PPC) by which it is stipulated that all interim payments are guaranteed by means of bank guarantees. Section a) allows the purchaser to execute a bank guarantee on the development not having even been started to be built after the delivery deadline is overdue, not being finished in time (*) or the developer failing to obtain the Licence of First Occupancy.(*) Almost all developments in Spain are delivered late so this remark by the law is advised to be taken with a pinch –or two- of salt in practice. Another fact worthy of highlight is that only because your PPC has a specific clause whereby it is mentioned you have a bank guarantee issued securing your funds this doesn’t mean you have one. You have to be thorough and crosscheck with your lawyer you do in fact have bank guarantees issued under your name securing all your deposits including the initial reservation fee.

- Article 3 stipulates that if the deadline is surpassed without the development being finished or even started the purchaser may execute their bank guarantee or else grant expressly the developer with an extension of the delivery date with an addendum to the PPC.

- In compliance with article 4, these guarantees will be cancelled upon the granting by the Town Hall of the First Occupation Licence. At completion the lawyer appointed by the purchaser will hand over these guarantees to the developer’s legal representative.

- Article 7 stipulates the Consumer’s Rights set forth in this law cannot be waived by the purchasing party even if they agree to it. These purchaser’s rights cannot be renounced under any circumstance.

Types of Bank Guarantees in Spain

As the Law 57/68 doesn’t specifically rule which type of bank guarantee should be issued by the developer there is freedom. Basically this allows for two types:

- Ordinary Bank Guarantee - Bank guarantees ideally can be claimed upon immediately by the purchaser in case the developer defaults or the property not being delivered. However post credit crunch this is no longer the case as some banks are refusing to honour them. Prior to executing it, it actually requires a judge’s ruling stating that the bank ought to refund –or not- the off-plan purchaser. This means that the purchaser will actually have to engage the services of a specialized litigation lawyer who will claim upon said bank guarantee in a special executive procedure. The litigation expenses are borne initially by the purchaser up front albeit may be claimed back from the bank together with the full refund of the stage payments and legal interests. This Executive procedure is much swifter than an ordinary court procedure spanning normally between 3-8 months. This is the most common type of bank guarantee which is set-up and one cannot argue that it is illegal or unlawful, it is only less practical if Banks happen to refuse honouring them.

- Aval a primer requerimiento -This is just an ordinary bank guarantee which includes a special clause by which it can be claimed upon immediately by the conveyance lawyer without the need of a judge’s ruling. The bank cannot refuse to honour it. This is really the ideal bank guarantee to have because it saves the hassle, stress and additional expenses of having to go through a Court Procedure, even if it’s an Executive one.

Obtaining a Bank Guarantee

Who requests a Bank Guarantee?

Ideally a developer should hand you over the bank guarantees without even having to request them, this seldom occurs of course. In practice it is the duty of the conveyance lawyer you appoint to request the bank guarantee from the developer. If you have appointed no lawyer then it will be up to yourself to request it from the developer. The developer in turn will arrange with the bank underwriting the whole development or with an insurance company the set-up of these bank guarantees.

Normally in off-plan property after having paid the initial security deposit which strikes the property off the market, you are typically required to make interim payments on 30/40% of the value of the property. These payments are normally made in regular instalments (i.e. 3 or 4). Your lawyer will then request from the developer one bank guarantee at a time to cover each and every instalment besides the initial security deposit. So normally your lawyer will have one bank guarantee for each of your stage payments securing the full amount.

As per this Law a developer cannot charge to issue a mandatory bank guarantee. Issuing a bank guarantee has high set-up fees for the developer as they must allocate an amount of money in a special bank account besides being a cost of opportunity for them as they could allocate these funds elsewhere. Perhaps this may help to explain why some developers may seem not be particular eager to hand them out willingly unless the purchaser’s lawyer has requested it from them.

When are Bank Guarantees Issued?

Bank guarantees are issued normally 30 or 40 days after you have made the down payment they are securing. Naturally a bank cannot issue a bank guarantee if you have yet not paid the stage payment. In other words, a bank guarantee cannot be issued prior to handing over the stage payment to a developer as some people are advocating publicly. This just shows a lack of understanding, however wishful, on how the system works.

Bank Guarantees on Self-Built Properties

I am building my own dream-villa, should the constructor hand me a bank guarantee? The answer is no. In this particular case in which a person has bought a plot of land and they are building their own detached villa the Building Act regards them as self-developers. The constructor is hired by them and is acting on their behalf. In this particular case bank guarantees are not applicable as the purchaser is the developer. However, Law requires the self-developer to arrange the mandatory Ten-Year Insurance (Seguro Decenal). A lack of compliance attaining this mandatory insurance will result in this self-developer being forbidden to sell their house within the next ten years whilst alive unless expressly waived by the purchaser.

Common Bank Guarantee Pitfalls

There are far too many pitfalls to be included in this brief bank guarantee overview. Please take professional advice from your appointed lawyer on this matter.

However, we will name the most common:

- The bank guarantee has a wording that makes it subject to the granting of the Certificate of End of Construction instead of the mandatory Licence of First Occupation. Law 57/68 sets forth in article 4 that the bank guarantee should be valid until the granting of the Licence of First Occupation. The problem is that a Certificate of End of Construction, which is the prerequisite prior to the granting of the Licence of First Occupation, doesn’t mean the development is regarded as legal. In fact the Certificate of End of Construction is issued by the architect in charge of the development who is actually on the developer’s payroll. Besides contradicting the specific wording of the said law this clause should not be accepted as a development in despite of having a Certificate of End of Construction issued may not be legal. Moreover, for the Certificate of End of Construction to be rendered valid it has to be signed by the architect, technical architect (aparejador) and must be approved and countersigned with the official seals of both the Architect’s regional College and Technical Architect’s regional College. So a Certificate of End of Construction only signed by one of them would not be deemed valid and bears no significance on the legality of the development. Only the Licence of First Occupation does.

- The Licence of First Occupation is conditioned to an Expiry Date. This is fairly common and contradicts blatantly both the spirit and wording of the law. The problem with expiry dates is that almost all developments are handed late for one reason or another. The danger in including expiry dates is that if the development isn’t finished on time as per the clauses in the Private Purchase Contract and the deadline is overrun the bank guarantee will cease to be valid. However this is a subject of hot controversy between lawyers and judges as there are many who believe that the inclusion of expiry dates is null and void as it goes against the Law. This will remain contentious until there is a string of likeminded rulings from the Higher Courts. In the meantime being practical, I would advise to renew your bank guarantees to ensure your financial interests are secured at all times should the worst occur.

- Cowboy Insurance Companies. On the wake of the long-lasting property boom many such cases have been reported in the media. Invariably these insurance companies are companies incorporated abroad specifically to be outside the reach of the Spanish Jurisdiction. On doing this they waive Spain’s requirements and should the developer default, they are purposely unable to back up the bank guarantees or insurance policies they have undersigned. The process to make them accountable for is long, winding, expensive and often fruitless. That is why it is most advisable that whichever Bank or Insurance Company that issues these bank guarantees is located within Spanish territory as a precaution. The Spanish Government has a list of unauthorised insurance companies in its website which it regularly updates which are not registered or authorised to trade in Spain.

- Group or collective bank guarantee whose beneficiary is not the purchaser.- This happens typically when an entrepreneur buys from the developer at a discounted price the whole development or a large number of units to resell it abroad in the UK or Ireland at a higher price. The bank guarantee will be under the name of this company and not under the name of the final individualised purchaser as it ideally should. These bank guarantees are normally for a very high amount of money (millions of Euros) as they group various residential units.

- My bank does not honour my bank guarantee. - Post credit crunch it is renowned that some banks are refusing to honour them as has been highlighted by the Bank of Spain itself. In this case a specific executive procedure may be followed by your lawyer as a bank guarantee is regarded as an Executive Title. However, not in all cases is it recommendable to follow this executive procedure and your litigation lawyer will advise accordingly. Consider it as a tactic devised to wear you out as litigation is daunting for many and requires to be paid up front. The expenses can normally be recouped from the other party later on.

Conclusion

A bank guarantee is a document of paramount importance for the off-plan purchaser as it secures their stage payments. We just cannot stress enough the importance of attaining a bank guarantee. So even if you are requested to pay a bank guarantee, which is unlawful, we would advise you to do so because it will act as a safety net securing your financial interests should the developer go into receivership or the development is stalled and overdue.

Discuss this Article

-

bnjsttgx Says:

Fri, Nov 21st 2008, 01:41

-

jo2326@yahoo.com Says:

Mon, Dec 1st 2008, 20:45

Do you know anything about UK bank guarantee?

I am dealing with an investment company in the UK which claims to provide bank guarantee. I am looking for a lawyer to help me with the process and verify if it is legit.

-

Lawbird Lawyer Says:

Tue, Dec 2nd 2008, 14:48

Dear Sir,

I'm sorry, we would only know about Spanish bank guarantees.

I suggest you hire a local UK solicitor to asses the legitimacy of the said BG.

Regards,

Raymundo Larraín Nesbitt

-

Suzanne Says:

Tue, Dec 2nd 2008, 15:32

Regarding those who do not have a BG; on another thread it was stated that 'Developers can be fined up to 25% penalty of the amounts they should have guaranteed'.

I was wondering how rigorously this is enforced? Is this up to the Judge presiding over a particular case, or up to a prosecuting lawyer to try & get this Fine enforced?

-

Lawbird Lawyer Says:

Tue, Dec 9th 2008, 15:59

Dear Suzanne,

It's up to your lawyer to pursue this penalty if his client wishes so.

However, we stress this is not a means to recover your deposits only to impose a punishment on the developer whose failed to comply with Law 57/68. That's why many people choose not to follow it because it doesn't really help them.

-

Stephen Austin Says:

Tue, Dec 9th 2008, 17:53

I have a bank guarantee it has an expiry date upon it. But this was only the 30th of Sept 2008, this was also the completeion date for the property. The developer has staed his intention not to proceed with the property. How do i go about getting my 30% deposit back.

-

aflores Says:

Sat, Dec 13th 2008, 12:29

Hello Stephen,

Bank guarantees can be executed, in principle, even if the expiry date has already been met. The reason is that Courts (and some banks) are considering that the applicable laws in this matter (57/1968 and 38/1999 Acts) prescribe that guarantees will be valid until the license of first occupation has been obtained, which in this case has not happened from what you say. I suggest that you try to execute the document withthe bank and if they refuse you take legal action, via the Courts.

-

Marion Williams Says:

Wed, Dec 17th 2008, 22:15

Hi, I am in a situation whereby I have bank gurantees by Caja España however one of them is a copy and they are stalling because of this. My lawyer says this is just a stallig tactic and they cannot refuse payment. Is this correct? Are Caja España a reputable bank?

-

Malcolm Says:

Wed, Jan 7th 2009, 14:48

My lawyer failed to obtain the original bank guarantee document though he did get a copy of it from the bank. He says the copy may not count and that only the original counts. Is this true?

-

Bernice Robinson Says:

Thu, Jan 8th 2009, 11:43

POST EDITED as per the real Mrs Robinson request.

-

Kevin Says:

Fri, Jan 16th 2009, 08:51

I have purchased an off plan apartment in Mojacar. The original contract was signed without a bank guarantee. I am now being asked to sign a new contract incorporating a parking space(not in the original price/contract) as the developer is claiming this is part of the planning requirement. Could this be true or could it be a way of raising more finance and selling the parking spots. If I sign the new contract presumably I should demand a bank guarantee prior to doing so.

-

Unregistered Says:

Sun, Jan 18th 2009, 12:27

Hello Malcolm,

A copy is not good to demand payment either a the banks premises or via the Courts but what you could do is request request from the Judge that the bank provides with an original, considering that these documents all have a serial number, and subsequently but simultaneously enforce the guarantee to obtain payment. This is definetely what I would do if I was a representing a client in your situation.

-

Steve Says:

Tue, Jan 27th 2009, 14:59

Hi Bernice

I am in the same development as you. Thanks for your post. I wonder if you would mind providing me with the contact details of the solicter you are using please.

Regards

Steve

-

Unregistered Says:

Wed, Jan 28th 2009, 08:02

Oh dear Bernice, £338 for a power of attorney! What a rip-off! Are you sure your lawyer is not in bed with this uk notary and getting a share of that money? Perhaps the fees he charges don’t include “hidden fees”

Our lawyers in spain not only win cases against developers as Aifos, they also make sure we are not cheated. The notary they recommended us in the UK charges £75 for a power of attorney. His contact details are:

Mr Robin Stephenson

Newcastle

01782 619225

-

A Morcom Says:

Wed, Feb 11th 2009, 17:27

If our conveyance lawyer was unable to obtain the promised bank guarantee should they have advised us to stop making further progress payments?

-

geoff.hackett@virgin.net Says:

Fri, Feb 20th 2009, 14:44

What happens if your solicitor fails to deliver the bank gurantees which are due at the time of the 30% deposit, stalls every time you ask, then the builder does not complete and goes into receivership and it emerges that there were never any guarantee. You then find that this has happened on a large scale, the police are investigating fraud such that the case will take several years and after police and legal costs there will be nothing left. Will the solicitors malpractice insurance provide a glimmer of hope.

I read your article but it becomes totally impossible to see bank gurantees until 30% has been handed over.

Can you advise

-

Lawbird Lawyer Says:

Mon, Feb 23rd 2009, 08:42

Dear Sir,

In this case the best option may be to claim against the professional indemnity insurance.

If you read the article, the obligation is of the developer to hand you the bank guarantees, its not the obligation of the lawyer, the law doesn't say that. And in fact the only penalties there are for breach in delivery are imposed on the developer not on the appointed lawyer.

That is why it is very important that the lawyer/law firm you appoint is independent.

-

kevin Sung Says:

Tue, Mar 24th 2009, 19:50

Hi.i bought off plan 2005 paid deposit then in 2007 got solicitor to check contract and get Ni number ect..long story short developer vailed to complete and is in jail,,employed spanish solicitor to take to court to get money back,,i now find that i have no bank guarantee,,should this have been brought up when contract was checked in 2007 as part of normal practice? i have asked the solicitor and as of yet had no action..seems we will win in court but as there is no bank guarantee and developer in jail no mney to be had..really angry that solicitor did not mention the so called guarantee that we were meant to have but seems we never got it..can you advise..

-

Lawbird Lawyer Says:

Wed, Mar 25th 2009, 12:52

Dear Sir,

I think you've opened a can of worms.

Law 57/68 establishes that it's the developer's duty to hand you a bank guarantee or insurance policy to secure your stage payments in an off plan purchase. The law doesn't mention anywhere it's the lawyers' obligation.

Furthermore in the Building Act (Law 38/99) the penalties are imposed only to developers, not the conveyance lawyer handling the matter, for failure of compliance on the issuance of bank guarantees.

That's what the Law prescribes.

Now we can start a contentious debate on whether lawyers are responsible or not to obtain these BGs from developers on behalf of their clients.

The fact is that in light of the above laws which specifically rule this matter nowhere does it mention that lawyers are obliged or its part of their duty of care to obtain them.

This is when I take the opportunity to add in a shameful plug as a disclaimer that our law firm has obtained always BGs to the entire satisfaction of all our conveyance clients in off plan properties before we ensue with the all too predictable lawyer bashing replies. Although in all honesty we've hardly done any significant conveyance at all in the past as we are specialised foremost in litigation.

We've written an article that endeavoured to wrap up neatly the matter of Spanish bank guarantees for off-plan properties. It's worth a read.

Another matter being what is our personal stance on this matter.

Our opinion is that it's obvious it's part of the integral duty of care of any conveyance lawyer towards his client to ensure that each and every stage payment, including the initial security deposit which strikes the property off the market, is secured by means of valid bank guarantees or insurance policies.

But our opinion is non consequential.

What matters really is what the Law rules and nowhere does it rule that it's the lawyers' duty, much less his responsibility, to secure them. Which is why on taking this matter up to a Bar Association it unsurprisingly fails as from a legal point of view the matter is clear in our humble opinion.

I believe one should clearly distinguish between lege ferenda and lege lata; even more so lawyers on passing legal advice and opinions in public venues.

It's always all too easy to post what the expat community wants to hear and receive the ensuing round of applauses. Albeit what's really difficult is when you write on how matters really work out in practice and receive the predictable flak for daring to be outspoken or dare to stand out-of-the-line in this politically correct World we all live in.

I am fully aware that the above statement may cause some controversy, but that's the legal exposition of how matters are currently. Which is why we always add the tag on our legal articles and advice.- make sure you hire an independent lawyer/law firm. Many of these legal pitfalls are easily avoidable having hired someone independent that cares only for your interests and has no vested interests of their own lurking away in their mind.

You can of course always follow the path of claiming against their professional indemnity insurance, providing they are registered lawyers, and see how that one works out.

If the laws need to be addressed on this grey area, so be it. But that's how things are currently and that's how we tell it.

Caveat emptor.

-

elaine Says:

Sun, Apr 26th 2009, 10:02

I have successfully claimed against my bank guarantees but the interest was not forthcoming, am I by law able to pursue this as the guarantee is binding? People I know have received 6% from the same bank!

-

Lawbird Lawyer Says:

Tue, Apr 28th 2009, 08:00

Dear Madam,

Yes you are entitled to the legal interest besides the principal insured amount. In some cases the interest may be 6% and in other cases less. It will depend on the wording of your Private Purchase Contract.

Please read our article on the matter:

Bank Guarantees: All That You Ever Wanted to Know but Were Afraid to Ask - 12 Nov 2008

-

Kathryn Cooke Says:

Tue, Apr 28th 2009, 08:10

We secured a property with deposit November2004. We paid 50% of the purchase price of our off-plan property in January 2005 due to be completed May 2006.

Building work on the site commenced, then stopped due to legal problems. Our property never even started.

We advised our lawyers in April 2008 to cancel and recover our money. We supplied power of litigation September 2008. We are still waiting and the lawyers never give details of procedure they are following or what is happening although I e.mail regularly. Bank guarantee expires May 2009. What can I do, how long will it take?

-

Lawbird Lawyer Says:

Tue, Apr 28th 2009, 12:15

Dear Madam,

Hasn't your lawyer already pulled out and litigated? Are you sure your lawyer is specialised in litigation?

Your lawyer should inform you on when the law suit has been filed. Normally we Spanish lawyers do not email regular updates nor on a weekly/monthly basis. We email only on major milestones along the legakl procedure such as:

1. Registered letter sent

2. PPC cancellation (pulling out of the contract)

3. Law suit being filed

4. Assets embargoed (if applicable)

5. Preliminary hearing

6. First Ruling

7. Second and normally Final ruling

You should really query your lawyer on wether he's filed the law suit already or not.

-

mike smith Says:

Sun, Jun 28th 2009, 14:52

Is there such a thing as a partial Licence of first occupation? If yes what is it have how does it work?

-

Lawbird Lawyer Says:

Wed, Jul 1st 2009, 13:44

Dear Mr Smith,

You should really be asking this question in this thread:

The Licence of First Occupation Explained - 29 Jan 2009

A LFO parcial is normal and there's nothing to worry about.

You have probably purchased on a large off-plan development with various phases such as the one I give as an example in the above article. For each of one of those phases a LFO is issued by the Town Hall, and they add the word "parcial" because it it is granted only for a given number of dwellings, not for all, i.e. for 80 dwellings out of 300 which are divided in 4 phases.

Yours faithfully,

Raymundo Larraín Nesbitt

-

Unregistered Says:

Mon, Jul 20th 2009, 17:49

We have deposits paid on 2 apartments which were not finised on time. A few months have passed and our lawyer is advising that we sue the developer as the bank has refused to honour the bank guarantee. The lawyer is asking for an up front payment but cant say how much the entire court case would cost. We appreciate that an exact figure would be difficult to give but we want an approximate amount. We have a lot invested already and would like to have an idea how much more would be involved. this is important as we would lose this on top of the rest if the case were lost. How would we get an idea of the costs involved?

-

Lawbird Lawyer Says:

Mon, Jul 20th 2009, 17:56

Dear Sir/Madam,

In our case clients on hiring us do know how much they will be charged so as to avoid unpleasant misunderstandments. A full breakdown of fees is worded in our Letter of Engagement on being retained.

It is very important you receive a written quotation otherwise legal fees may turn out to be exorbitant.

Legal fees will vary depending on the work involved on litigating. Normally our legal fees are split between an initial up front retainer fee and a contingent fee dependant on the result achieved.

Please contact us if you wish us to provide you a quote free of compromise so you have an approximate idea of what to expect.

You can read our litigation blog on some of the cases we've won recently.

-

Mark Smith Says:

Sun, Aug 23rd 2009, 20:51

I purchased an off plan development in Arenal Golf, Benalmadena in 2005. We cancelled via our soliciter in 2008 but are still waiting. The solicitor offered us to join in litigation but for an additional 7000 euros and to be honest they have been that bad and never kept us upto date I don't want to give them anymore of my money. We have a bank guarantee but this seems to make no difference they are refusing to pay. We are at our wits end what can we do? We are owed £50,000

Mark & Chris

-

Lawbird Lawyer Says:

Mon, Aug 24th 2009, 07:06

Dear Mr Smith,

Please contact us on your matter and we'll be glad to assist yuu, thank you.

Yours faithfully,

-

Jackie hearn Says:

Sun, Nov 15th 2009, 16:22

Hi, we have just received 77,000 euro's banc guaranteed from banc of popular but no interest or our 1st intial deposit,3,000 as per our contract with peinsa? we have had such a bad year with all what they have put our two families through, can you give advise ref; 1st deposit and interest as the interest over 2 years and 4 months is 14,200 which is a lot of money for our families who sold family homes to secure these properties and was living in rented properties for over 2 years. Peinsa builders have cost our two familes a fortune.

HOPE YOU CAN HELP,

many thanks kind regards

Msr Jackie Hearn

Fot The Hearn & Hunter families

-

Lawbird Lawyer Says:

Mon, Nov 16th 2009, 09:19

Dear Mrs Hearn,

Under Spanish law, law 57/68, banks or insurance companies have to pay you the accrued legal interest, besides the principal, whether the bank guarantee or insurance policy mentions it or not.

Please contact us and we will gladly deal with your matter.

Yours faithfully,

Raymundo Larraín Nesbitt

-

vito Says:

Wed, Dec 16th 2009, 18:53

I am acting as a broker and have investors interested to purchase bank guarantees from Portugal. I am looking a binding contract to secure my commission in case I successfuly cause the transaction between the buyer and the seller.

-

stanley brewer Says:

Tue, Mar 23rd 2010, 12:43

the lawyer i had in spain failed to get my bank

guarantee, and now is asking for a lot of money for there services, the builder is going out of buisness, can i sue the lawyer for not getting my guarantee as i will loos a lot of money could take years to get my money back through the courts, i am a pensioner an cant afford to loos that money

-

Lawbird Lawyer Says:

Tue, Mar 23rd 2010, 14:10

Dear Mr Brewer,

Please read the detailed reply we have written in post number 19 of this thread:

http://www.marbella-lawyers.com/forums/showthread.php?t=78&page=2#19

A lawyer may have requested from a developer a BG but the developer may not have issued it. If your lawyer is able to prove he sent registered letters or faxes requesting a Bank Guarantee your case against him will most likely fail.

The obligation to issue BG's following our laws is only of the developer, not of the lawyer.

Moreover, laws sanction only the developer, not the lawyer, on failing to provide an off-plan buyer with one.

Which is why when lawyers are sued over the issue of Bank Guarantees most of these actions fail because of the above two reasons. If in addition the lawyer can prove he actually did request them the case is bound to be turned down,

Yours sincerely,

-

Graham Embleton Says:

Tue, Apr 6th 2010, 13:35

I purchased a property on the Almanzora country Club in Mazzaron in May 2005. The development has since been abandoned due to planning problems. And I subsequently cancelled the contract. I recieved a bank guarantee for my first stage payment after much harrassment.I have had this money paid back. However I could not get a guarantee for my 2nd payment of 30,000 euros despite numerous e-mails to the builder Huma Medditteraneo SL. Have I any legal recourse on the bank directly to pay back the monies deposited in there bank.

-

Lawbird Lawyer Says:

Tue, Apr 6th 2010, 14:47

To be honest it's difficult but not impossible. It will depend on your risk threshold to assume more or less risk litigating.

We've recovered client deposits with only photocopies of bank guarantee and at times with not even with a copy at all and at others even executing collective bank guarantees. But it's fairly difficult and lengthy. If you take this path you must be fully aware of the risk you take.

It boils down to the wording of the purchase contract, to whether the bank did open a special escrow account to deposit off-plan payments as per Law 57/68 and if the money is still being held there etc. It's not an exact science.

Yours faithfully,

-

Lin and Tez Mayne Says:

Fri, Apr 16th 2010, 12:14

We also purchased on Almanzora Country Club but never received any BG's for any of our stage payments. We won our legal action against the builder but are still waiting for our money. We bought through an agent and they were supposed to apply for the BG's but again we never received them, despite constant promises from the agent that they were on their way. The agent ignores all our correspondence and has refused to help us, so we are completely on our own apart from our solicitor, who we appointed when we cancelled our plot. What can we do now as we are due to retire in only 3 years time and are now living in a rented property, so we will not be able to survive once we retire, as we sold our family home to purchase this doomed property? Do we have any recompense against the agent? Thanks

-

Lawbird Lawyer Says:

Fri, Apr 16th 2010, 12:30

Dear Mr and Mrs Mayne,

I'm sorry to hear your case.

Regarding your legal query, an estate agent cannot be held liable on failing to provide Bank Guarantees securing your off-the-plan stage payments.

No estate agent does this, nor is it their professional duty.

Our laws clearly state that it's the developer's duty to hand them over as explained in the article which starts off this thread.

As a sidenote, only because you lack a BG does not mean you will never be refunded or your money is lost. Many off-plan buyers retrieve their deposits litigating and they were never issued a bank guarantee in the first place.

You can read further:

Is Litigation Against Spanish Developers Worthwhile? - 23rd May 2008

Lawbird's Blog

Yours faithfully,

Raymundo Larraín Nesbitt

-

Susan Hughes Says:

Mon, Apr 19th 2010, 22:14

Dear Lawbirds,

If first occupation licence is granted on the only complete phase of a site that is having major subsidance problems on another phase and the third phase will not be completed in the forseable future, should the bank guarantee still be valid?

-

Lawbird Lawyer Says:

Tue, Apr 20th 2010, 09:02

Dear Madam,

As per law 57/68 a BG is only valid until a Town Hall issues a LFO.

The moment the developer attains a LFO, the BG securing the stage payments for those properties included in the LFO ceases to be valid (Art 4 of the said law).

Quoting my article on Licence of First Occupation:

The Licence of First Occupation Explained - 29th January 2009

Is Every Off-plan Development Issued a Habitation Licence?

Yes. As previously written, each dwelling has its own individual LFO granted, although in large developments they are normally grouped for simplicities sake. A detached villa will have its own individual LFO whereas large developments consisting of various phases will have grouped LFOs issued. Each of these phases normally has its own LFO. So for example in a huge development of 300 units grouped in 4 phases there could be four different building licences and you would have one all-inclusive LFO granted for each individual phase grouping 75 dwellings at a time. This could well mean that even within the same finished development some properties may be legal (with a LFO granted) yet others are not legally deemed as habitable yet. You could only tell which are which by means of thorough legal analysis. Another matter being if the local authorities actually pursue those who live in, or let properties which lack the mandatory LFO, but I’ll reserve that for another occasion.

As I explain above, a development normally comprises three or more phases. Normally a LFO is issued for each of these phases as each one will have its own Building Licence. So if in your case you have three separate phases and only the first one is finished BG's for phases two and three should still be enforceable as no LFO has been attained.

In any case to make sure I would need to review the documents.

I hope the above clarifies your query.

Yours faithfully,

Raymundo Larraín Nesbitt

-

Marie Says:

Wed, Jun 16th 2010, 18:17

Would you please let me know how or where do I find "Registro Especial de Avales" ?? is it in the same bank, when talking of Bank garantees ?? I mean where do they register a Bank garantees ?? It is a special " Register" for these purposes ?

-

Lawbird Lawyer Says:

Thu, Jun 17th 2010, 08:49

Dear Madam,

Yes they are registered within the issuing bank or Insurance company.

So each bank will have its own centralised registry in which bank guarantees issued by any of its regional branches will be lodged in.

Yours faithfully,

-

Carol Poots Says:

Sun, Oct 3rd 2010, 09:45

Hi

We have two Bank Guarantees from Cajamurcia these are both for approximately 38 thousand euros. we where given an approximate completion date of the 31 March 2009. However to date the property has not even been started. Is it possible for me to contact the bank directly to ask for my refund under article 3 of law 57/1968. How likely is it that they would refund my deposit without having to take legal action as i understand this legal action could cost up to 10 thousand euros and take 18-24 mths. These guarantees have expiration dates. I have contacted my solicitor with regard to this and he has advised me that they will be valid until such dates as the propery id delivered.

I would be extremely grateful for any information that you can give me.

Regards

Carol

-

aflores Says:

Tue, Oct 5th 2010, 08:12

Hello Carol,

Legal action should not cost you so much, as 72k Euros will attract approximately 5.000 Euros in legal fees plus procurator (800 Euros). It is possible that you walk into the bank with the documents and ask the manager to process them, but whatever you do, don't give them the originals!

I would encourage you to go ahead but equally I suspect that they will delay a response indefinetely or will respond you to the effect that they are not liable for payment since the date is expired (which as your solicitor quite rightly points out, is illegal). It is then when you need to take legal action.

Kind regards

-

carol poots Says:

Wed, Oct 6th 2010, 11:52

Thank you Aflores.... i think we'll give it a go.

Regards

Carol

-

aflores Says:

Thu, Oct 7th 2010, 04:17

Good luck Carol!

-

Bob Says:

Mon, Oct 25th 2010, 11:26

Hi, is it usual practice for a lawyer to charge a fee of 10% plus VAT on the total amount recovered on a bank guarantee? The matter did not go to Court and was settled within 2 months, insurance company paid out on the guarantee without need for legal action. I realise this meant no added stress and delays in receiving our money, but 10% seems excessive. Best regards Bob

-

Blob Says:

Mon, Dec 13th 2010, 13:25

Hi. Could you please help with a property dilemma we have? We put a deposit down on a property in Spain in 2007 however the development appears to have been scaled back and our particular property has never been built. There are lots of aspects to our particular case which I wont go in to details on right now however our lawyer tells us that in Feb of this year, he prepared the documents to present to Santander to claim on the bank guarantee. We have heard nothing positive since then and feel we are being "stalled" by our lawyer. Do you know who /what department we should contact at Santander in order to check that our claim has actually been presented to them? Many thanks

-

lawbird Says:

Wed, Dec 22nd 2010, 16:13

Hi Bob,

Despite there being a guideline of professional fees regulating the profession, a Lawyer and his client can negotiate the professional fees in whatever terms they see fit and taking into consideration the risks to be undertaken by your solicitor and other factors sourrounding your problem.

If you agreed on those terms and conditions and signed a letter of engagement, then you must fulfill the payment obligations you assumed under that contract, despite that they now seem excessive to you.

Success fees are usually high, because they compensate the risks that the Lawyer assumed in taking your case. If he would have not been able to recuperate any money, he would have invested a large amount of his time and knowledge and not received the professional fees corresponding to that amount of time he has incurred. However, in this last scenario he would not have been able to come back to you and ask you for more money to compensate this loss.

In any case, with the current financial climate, almost 1 out of 4 purchase contracts are being successfully rescinded with buyers obtaining the full amount of their deposit back, so you certainly have many reasons to celebrate this time of the year.

Kind regards,

-

lawbird Says:

Wed, Dec 22nd 2010, 16:26

Dear Blob,

In relation to your query, please note that the Spanish Solicitors’ Code of Conduct forbids us to act when there is another Lawyer instructed on your matter.

Even if this wasnt the case, the Bank's Legal Department is quite large and we wouldnt know who is dealing with your claim since we do not have the branch details, nor a reference number, or property details, or any other details that could let us know what exactly has been done in pursuance of your case and what is the current status of the claim.

I suggest that you contact your solicitor and obtain this information from him as he is the one who presented the claim and knows who is dealing with it and what has happened until now. If you distrust him, ask him for a copy of what he has presented on your behalf and an explanation of what exactly is ocurring. I am certain he will be pleased to inform you.

If despite the above you are still unhappy with his service or think that his or her situation has been compromised, there is a procedure you can follow in order to replace him.

Should you be interested in having your solicitor replaced, please fill in the following form and we will contact you with further information:

http://www.lawbird.com/services/contact

Kind regards,

-

Russ Says:

Sat, Aug 20th 2011, 19:26

Hello All, I was wondering if anyone could provide me some assistance. I was purchasing a vehicle from an individual who was suppose to be in Spain that ended up being fraud. The money was transfered to a bank in Spain (La Caixa) and as soon as I was aware of the fraudulent transaction I was able to block the funds from removal in Spain. To get these funds returned to me the bank has requested a police report (which we sent) as well as a letter of guarantee. My bank in Canada has never had to issue this type of document before and has requested a "sample" letter so they can get some thing produced here. If someone could supply either information or a sample document that would be fantastic. At this stage we hit a bit of a road block due to langrage issues at the bank as well as difficult in getting the back to respond in a timely fashion. At this stage were 2 months into this process and were just getting to the stage on what documents are required to get this completed.

Thanks Russ

-

Howard Lester Says:

Wed, Sep 28th 2011, 11:19

We bought off plan in Denia, Spain in 2003 and paid a stage payment. We were not issued with a back guarentee neither were we advised by our lawyer that we should have one. The developer has been bankrupted and we have won a court judgement but there is no fund to repay our loss. Who is responsible for the issue of the BG, is it the bank, the developer or the original Abogado. Is there any point in persuning a claim?

-

Joe Sem Says:

Fri, Jan 13th 2012, 13:07

My company has 3 bank guarantees open with the Spanish Customs Authority dating back to the early 80s. We are trying to close the bank guarantees but neither us or the Spanish Customs Authorities have the original documents. The only surviving proof is a copy by the bank.

Although both parties are agreeing to close the guarantees, the bank will not allow us to close without the original documents.

Any Ideas on how to close them?

-

Peter Dawson Says:

Mon, Jan 16th 2012, 12:41

I engaged a lawyer in the summer of 2006 to handle my affairs when dealing with the developer.

The lawyer claimed to be a ‘specialist solicitor’ in dealing with purchases of this type and I was given a booklet written by their senior solicitor outlining how my deposits would be ‘risk free’ and secured by bank guarantee.

Specifically they said in the booklet that care should be taken to ensure my money was deposited into a special bank account and a copy of the bank transfer be obtained.

My money was deposited into 2 banks under their instructions, Valencia and Santander. Subsequently a bank guarantee was issued by Valencia along with a ‘note’ from the developer, a copy of which I did not receive until after the developer went into liquidation in 2010, stating that my money was transferred to the ‘special account’.

When we invoked the guarantee Valencia would only return £20,000 GBP and I have ‘lost’ £22,000 GBP because the developer did not in fact transfer my money.

I therefore hold the solicitor negligent in not ensuring my money was protected and in breach of contract in not doing what they said they would do in the booklet they gave to me.

Do I have a case against the solicitor?

-

Patricia Says:

Mon, Jan 16th 2012, 17:02

Dear Mr. Dawson,

I understand you concern and that you must certainly claim that the property purchase was so badly processed in the end, however, the lawyer is not responsible of the bank guarantees procedure once the money has been transferred to the developer; it is responsibility of the developer entirely. The lawyer must make sure that the bank guarantees have been requested, to protect the client´s interests in the future. I recommend you to contact an expert solicitor that can study the documentation and advice on where you stand and how to claim your funds back if possible. If you wish you can contact me on Patricia at Lawbird.com so we assist further.

Best Regards,

-

ian Says:

Tue, Jan 17th 2012, 13:02

goodafternoon i bought off plan a house in lamanga we have full bank guarenties,the house is nearly two years late but we have been patient as this was to be the house off our dreams we moved to spain in feb 2011 for good but the house was not ready after many delays we were advised by the developer that in june all the habitation licences would be in place and we could complete our purchase we had a mortgage valuation and a mortgage offer in writing we were ready to go and the developer alloud us to move in to the property assuring us that we would complete in two weeks,since this time the developer has fallen on hard times suppliers have not been paid and he refuses to talk to us,now we have decided that it is impossible for us to complete so we have started down the road off getting our bank guarrenties back as we need to get on with our lives,and as far as we are concerned the developer has not completed the contract.we have requested our money back vie the bank guarenties we are waiting to here,we are still in the house as we have no where else to go and we have allready invested 700.000 euros into the house and for us to loose that amount would be a dissaster.can u please advise what we should expect.

-

Patricia Says:

Tue, Jan 17th 2012, 15:54

My company has 3 bank guarantees open with the Spanish Customs Authority dating back to the early 80s. We are trying to close the bank guarantees but neither us or the Spanish Customs Authorities have the original documents. The only surviving proof is a copy by the bank.

Although both parties are agreeing to close the guarantees, the bank will not allow us to close without the original documents.

Any Ideas on how to close them?

Hello Joe,

The fact of having lost the original documents does not allow the bank to refuse to cancel the guarantees, especially if the beneficiary of the same ( Spanish customs ) expressly accepts it. The most advisable thing to do is to go to the bank with a representative of the Customs dept. to cancel the bank guarantees, and if they refuse due to the lack of original documentation, the cancelation application could then be signed before a Notary mentioning that the original documentation was lost, and then filing that document at the bank. If, even after these actions, the bank still refused to cancel the guarantees, you could address the Bank´s consumers´ Protection regulations. If this did not have a positive result either, the Bank of Spain or even a Judge could have the last word, presumably, in your favour.

Regards,

-

Patricia Says:

Thu, Feb 9th 2012, 14:57

Hello Ian,

Please accept my apologies for this late reply.

We can study your case if you let us have a look at the corresponding documentation.

Please feel free to send me an e-mail on Patricia at Lawbird.com with the relevant documents and I will be able to offer you the required legal advice within 3 days maximum.

Best Regards,

-

Colin Says:

Thu, Feb 9th 2012, 21:00

Hello Ian,

You are enlightening. Tell me please, what if a development had offered bank guarantees however your lawyer failed to get them despite all other client lawyers on the development being successful? The lawyer told us that he had general guarantees which were equally as good - strangely enough they are not.

If you have time to reply then very much appreciated.

Regards,

Colin

-

Jason Says:

Mon, May 7th 2012, 17:31

This article is the most updated I have seen regarding this controversial matter (and rip-off!), interesting reading:

http://www.lawbird.com/wordpress/bank-guarantees-case-law-and-la-fortuna-golf-residencial-pinatar-el-pinet-and-others/

-

barbara jago Says:

Tue, Oct 23rd 2012, 10:50

dear sirs I bought off plan unaware that I needed bank guarrantee. I paid 350.000for the apatment and signed the escratura which was notorized. After three years the bank told me that they are putting the apt up for auction because the developer still owes them money, on the development. I have been told by lawyers there is nothing I can do unless I want to pay235.000 euros to the bank. This being the sum the developer owed including three years interest and expenses. The developer went into liquidation and millions of euros worth of assets were taken...why wasn't the bank entitled to take what he owed from that money. The developer now lives in Peru.I am 74 years of age and losing my apatment is devastating. But truly no one seems to care.

-

Marta Says:

Mon, Nov 5th 2012, 17:44

Dear Barbara,

To be in a position to give you more information on your particular case, we would need to see a copy of the escritura which you signed on the day. Would you be able to send me an e-mail with this information?

-

Gillybobs Says:

Sat, Feb 20th 2021, 08:06

I wish the advice you give out here was meticulously adhered to when you were working with Andalucian Dream Homes. I never received an Interlaken 2003 SL Bank Guarantee and also the one I did receive for that site failed to include IVA.

-

Gilybobs Says:

Sat, Feb 20th 2021, 08:08

The Bank Guarantee that didn't include the IVA was for La Condesa de Mijas Golf. I am taking these matters further.

|